Rebalancing Your Portfolio in 2025: Expert Timing Tips

Rebalancing your portfolio in 2025 involves strategically adjusting your asset allocation to align with your financial goals and risk tolerance, considering market conditions and economic forecasts to optimize returns and manage potential risks effectively.

Wondering if is now the time to rebalance your portfolio? Expert advice for 2025 suggests it might be a strategic move. Markets are always changing, and keeping your investments aligned with your goals is essential to long-term financial health.

Understanding the Need for Portfolio Rebalancing

Portfolio rebalancing is a critical aspect of investment management. It ensures your asset allocation remains aligned with your financial goals and risk tolerance. Over time, different asset classes perform differently, causing your portfolio to drift away from its original allocation.

Rebalancing involves selling some assets that have increased in value and buying others that have decreased. This process helps you maintain your desired asset mix and can potentially reduce risk and enhance returns.

Why Rebalance Your Portfolio?

Rebalancing isn’t just about maintaining your asset allocation; it’s about managing risk and optimizing returns. Here are some key reasons to rebalance:

- Risk Management: Rebalancing helps keep your portfolio’s risk level consistent.

- Seizing Opportunities: Buying assets that have decreased in value allows you to capitalize on potential future growth.

- Staying Aligned with Goals: As your financial goals change, rebalancing ensures your portfolio reflects your current needs.

Ultimately, rebalancing is a disciplined approach to investment management that keeps you on track towards your financial objectives.

Assessing Your Current Portfolio in 2025

Before rebalancing, it’s essential to understand your current portfolio’s composition and performance. This involves reviewing your asset allocation, investment performance, and any changes in your financial goals or risk tolerance.

Take the time to evaluate each asset class and determine how it has contributed to your portfolio’s overall performance. This analysis will help you identify areas that need adjustment during the rebalancing process.

Key Steps in Assessing Your Portfolio

Here’s a breakdown of the steps involved in assessing your existing portfolio:

- Review Asset Allocation: Determine the percentage of your portfolio allocated to each asset class (e.g., stocks, bonds, real estate).

- Evaluate Investment Performance: Analyze the returns of each asset class and individual investments.

- Consider Financial Goals: Assess whether your current portfolio aligns with your long-term financial goals and risk tolerance.

By thoroughly assessing your portfolio, you’ll be well-prepared to make informed rebalancing decisions.

Understanding Market Conditions and Economic Forecasts

Market conditions and economic forecasts play a crucial role in determining the timing and extent of portfolio rebalancing. Factors such as interest rates, inflation, and economic growth can significantly impact asset class performance.

Staying informed about these macroeconomic trends can help you anticipate potential market shifts and adjust your portfolio accordingly. Expert advice often emphasizes the importance of considering both short-term and long-term economic outlooks.

Expert Insights for 2025

As we move into 2025, consider these insights:

- Interest Rate Environment: Monitor interest rate trends and their potential impact on bond yields and stock valuations.

- Inflation Expectations: Assess inflation forecasts and how they might affect different asset classes.

- Economic Growth Projections: Review economic growth projections and their implications for corporate earnings and investment returns.

By integrating these insights into your rebalancing strategy, you can make more informed decisions that align with the prevailing economic climate.

Strategies for Rebalancing Your Portfolio

There are several strategies you can use to rebalance your portfolio. The best approach will depend on your individual circumstances, financial goals, and risk tolerance. Some common strategies include:

Time-based rebalancing, threshold-based rebalancing, and cash flow rebalancing are all viable options. Each has its own advantages and considerations, so it’s essential to choose the strategy that best fits your needs.

Common Rebalancing Techniques

Here’s a closer look at popular rebalancing techniques:

- Time-Based Rebalancing: Rebalance your portfolio at regular intervals, such as quarterly or annually.

- Threshold-Based Rebalancing: Rebalance when your asset allocation drifts beyond a certain threshold (e.g., 5% or 10%).

- Cash Flow Rebalancing: Use new cash inflows to rebalance your portfolio, directing investments to underweighted asset classes.

By understanding these different techniques, you can select the one that aligns with your investment style and preferences.

Tax Implications of Portfolio Rebalancing

Rebalancing your portfolio can have tax implications, especially if you’re selling assets in taxable accounts. Capital gains taxes may apply to profits made from selling appreciated assets. It’s essential to consider these tax consequences when making rebalancing decisions.

Strategies such as tax-loss harvesting and using tax-advantaged accounts can help minimize the tax impact of rebalancing. Consulting with a tax professional can provide personalized guidance on navigating these complexities.

Minimizing Tax Impact

Here are some strategies to consider:

- Tax-Loss Harvesting: Sell assets that have declined in value to offset capital gains taxes.

- Tax-Advantaged Accounts: Utilize retirement accounts like 401(k)s and IRAs to rebalance without immediate tax consequences.

- Asset Location: Hold tax-inefficient assets (e.g., high-dividend stocks) in tax-advantaged accounts and tax-efficient assets (e.g., growth stocks) in taxable accounts.

By being mindful of tax implications, you can rebalance your portfolio more efficiently and preserve more of your investment gains.

Long-Term Considerations for Portfolio Management

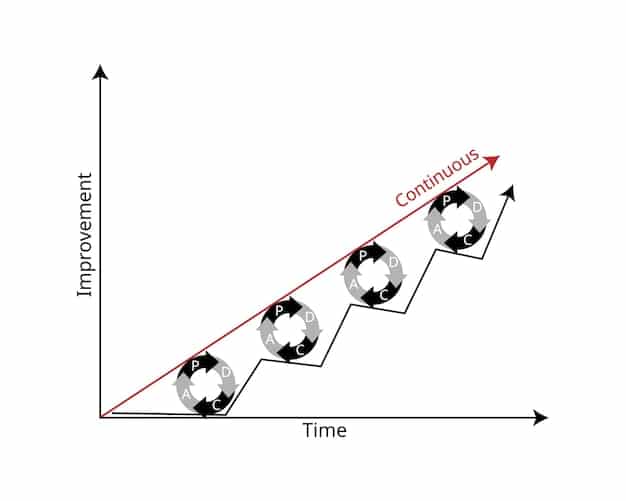

Portfolio rebalancing is not a one-time event but an ongoing process. As your financial goals, risk tolerance, and market conditions evolve, you may need to adjust your rebalancing strategy accordingly. Long-term portfolio management involves regularly reviewing your investment plan and making necessary adjustments to stay on track.

Staying disciplined and maintaining a long-term perspective are essential for successful portfolio management. Avoid making impulsive decisions based on short-term market fluctuations, and focus on achieving your long-term financial goals.

Tips for Long-Term Success

Consider these strategies for long-term portfolio management:

- Regular Review: Review your portfolio at least annually to assess its performance and alignment with your goals.

- Stay Disciplined: Avoid making emotional investment decisions based on market volatility.

- Seek Professional Advice: Consider consulting with a financial advisor for personalized guidance and support.

By taking a proactive and disciplined approach to portfolio management, you can increase your chances of achieving your financial objectives.

| Key Point | Brief Description |

|---|---|

| ⚖️ Asset Allocation | Maintaining your desired mix of investments to align with your risk tolerance. |

| 📈 Risk Management | Rebalancing helps control risk by selling over-performing assets. |

| 💸 Tax Implications | Consider tax-loss harvesting and tax-advantaged accounts to minimize tax impact. |

| 📅 Regular Review | Review your portfolio annually to ensure it still aligns with your goals. |

Frequently Asked Questions

▼

Portfolio rebalancing is the process of adjusting your asset allocation to maintain your desired risk and return profile. It involves selling assets that have increased in value and buying those that have decreased.

▼

The frequency of rebalancing depends on your individual circumstances and investment strategy. Many investors rebalance annually or when their asset allocation drifts beyond a specific threshold, such as 5% or 10%.

▼

Rebalancing can trigger capital gains taxes if you sell assets in taxable accounts. Strategies such as tax-loss harvesting can help minimize these tax consequences. Consult with a tax professional for specific advice.

▼

You can rebalance your portfolio yourself if you have the knowledge and time to do so. However, a financial advisor can provide personalized guidance and help you navigate complex investment decisions.

▼

Consider your financial goals, risk tolerance, current asset allocation, market conditions, and tax implications when rebalancing. Staying informed and disciplined is key to successful portfolio management.

Conclusion

In conclusion, deciding if is now the time to rebalance your portfolio? Expert advice for 2025 points to a proactive approach. By understanding the benefits of portfolio rebalancing, assessing your current portfolio, and considering market conditions, you can make informed decisions that align with your financial goals and risk tolerance, setting you up for long-term investment success.