Investing in ETFs: Your Comprehensive Guide for the Current Market

Investing in ETFs: A Comprehensive Guide to Exchange-Traded Funds in the Current Market offers a thorough overview of exchange-traded funds, from understanding their structure and benefits to strategically incorporating them into your investment portfolio, tailored for navigating today’s dynamic market conditions.

Are you looking to diversify your investment portfolio or explore new avenues for financial growth? Investing in ETFs: A Comprehensive Guide to Exchange-Traded Funds in the Current Market can be a strategic move. Let’s explore how ETFs work and how you can utilize them.

Understanding ETFs: A Primer

Exchange-Traded Funds (ETFs) have become increasingly popular, offering diversification and flexibility to investors. Understanding their basics is essential before diving into investing in ETFs: A Comprehensive Guide to Exchange-Traded Funds in the Current Market.

ETFs are investment funds traded on stock exchanges, similar to individual stocks. These funds hold a basket of assets, such as stocks, bonds, or commodities, providing instant diversification.

Key Characteristics of ETFs

ETFs offer unique advantages over traditional investment options. Their structure and trading mechanics make them a versatile tool for various investment strategies.

- Diversification: ETFs hold a variety of assets, reducing the risk associated with individual stock picks.

- Liquidity: They can be bought and sold throughout the trading day, providing flexibility for investors.

- Transparency: ETF holdings are typically disclosed daily, offering insight into the fund’s composition.

Investors appreciate ETFs for their simplicity and cost-effectiveness. They offer a way to access different market segments and investment strategies without the need for extensive research into individual securities.

In summary, ETFs provide a diversified, liquid, and transparent investment option suitable for a wide range of investors. Their flexibility allows for both long-term investing and short-term trading strategies.

Benefits of Investing in ETFs

Investing in ETFs: A Comprehensive Guide to Exchange-Traded Funds in the Current Market offers several benefits that cater to various investment goals. Let’s explore why ETFs are a popular choice among investors.

One of the primary benefits is diversification. ETFs allow you to invest in a diversified portfolio with a single transaction. This reduces the risk associated with holding individual stocks.

Cost Efficiency

ETFs generally have lower expense ratios compared to actively managed mutual funds. This means you pay less in fees, allowing more of your investment to grow.

Accessibility

ETFs are available to almost any investor with a brokerage account. They provide access to markets and asset classes that might otherwise be difficult or expensive to reach, such as international equities or commodities.

- Tax Efficiency: ETFs can be more tax-efficient than mutual funds due to their structure and lower turnover rates.

- Flexibility: ETFs can be used for a variety of investment strategies, from passive index tracking to active sector rotation.

- Transparency: ETF holdings are typically disclosed daily, giving investors clear insight into what they own.

Another significant advantage is the ability to implement specific investment strategies. Whether you’re looking to track a particular index, invest in a specific sector, or hedge against market volatility, ETFs can provide a targeted approach.

In conclusion, the benefits of investing in ETFs include diversification, cost efficiency, accessibility, tax efficiency, flexibility, and transparency, making them a compelling option for both new and experienced investors.

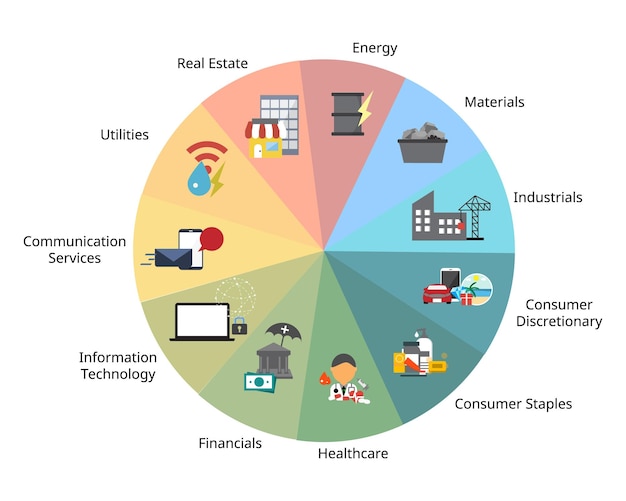

Types of ETFs Available

The world of ETFs is vast and diverse, offering a wide array of options to suit different investment objectives. Investing in ETFs: A Comprehensive Guide to Exchange-Traded Funds in the Current Market requires understanding the types of ETFs available.

Index ETFs are designed to track a specific market index, such as the S&P 500 or the Nasdaq 100. These ETFs aim to replicate the performance of the underlying index.

Sector ETFs focus on specific sectors of the economy, such as technology, healthcare, or energy. They allow investors to target particular industries they believe will outperform the market.

Bond ETFs

Bond ETFs invest in various types of fixed-income securities, such as government bonds, corporate bonds, or municipal bonds. They provide diversification within the bond market.

Commodity ETFs

Commodity ETFs track the prices of physical commodities, such as gold, silver, or oil. These ETFs can be used to hedge against inflation or to profit from commodity price movements.

- Actively Managed ETFs: Unlike index ETFs, actively managed ETFs have a portfolio manager who makes investment decisions with the goal of outperforming a specific benchmark.

- Inverse ETFs: These ETFs are designed to profit from a decline in the underlying index or asset. They use derivatives to achieve the opposite performance of the benchmark.

- Leveraged ETFs: Leveraged ETFs aim to amplify the returns of an index or asset, typically by a factor of two or three. However, they also magnify losses.

The array of ETF types allows investors to customize their portfolios based on their specific risk tolerance, investment goals, and market outlook. Understanding the nuances of each type is crucial for effective portfolio construction.

To summarize, the different types of ETFs – including index, sector, bond, commodity, actively managed, inverse, and leveraged – offer a wide range of investment options. Each type serves a unique purpose, enabling investors to tailor their investments to their individual needs and objectives.

How to Choose the Right ETFs

Selecting the right ETFs for your portfolio requires careful consideration of several factors. Investing in ETFs: A Comprehensive Guide to Exchange-Traded Funds in the Current Market involves making informed decisions based on your investment goals and risk tolerance.

Begin by defining your investment objectives. Are you looking for long-term growth, income, or capital preservation? Your goals will guide your ETF selection.

Assess your risk tolerance. Are you comfortable with higher volatility for the potential of higher returns, or do you prefer more conservative investments?

Expense Ratios

Consider the expense ratios of the ETFs you are evaluating. Lower expense ratios mean more of your investment goes towards returns, rather than fees.

Trading Volume

Check the average daily trading volume of the ETF. Higher trading volume typically means tighter bid-ask spreads and easier execution of trades.

- Underlying Index: Understand the index or asset class the ETF is tracking. Ensure it aligns with your investment strategy.

- Tracking Error: Evaluate the tracking error, which measures how closely the ETF follows its underlying index. Lower tracking error is generally preferred.

- Fund Composition: Examine the ETF’s top holdings. Make sure you are comfortable with the concentration and composition of the assets.

Another important factor is to diversify your ETF holdings. Just as you diversify across individual stocks, it’s important to diversify across different types of ETFs to manage risk.

Choosing the right ETFs involves aligning your investment goals with your risk tolerance, evaluating expense ratios, trading volume, underlying index, tracking error, and fund composition, and diversifying your ETF holdings for effective risk management.

Strategies for Investing in ETFs

Effective strategies for investing in ETFs: A Comprehensive Guide to Exchange-Traded Funds in the Current Market can maximize your returns and manage risk. Let’s delve into some popular and effective approaches.

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the ETF’s price. This strategy can reduce the impact of market volatility.

Buy-and-hold is a long-term strategy where you purchase ETFs and hold them for an extended period, regardless of short-term market fluctuations. This approach benefits from compounding returns.

Core-Satellite Investing

This strategy involves building a core portfolio of broadly diversified ETFs and supplementing it with satellite holdings in specific sectors or asset classes. It balances diversification with the potential for higher returns.

Tactical Asset Allocation

Tactical asset allocation involves adjusting your ETF holdings based on short-term market conditions and economic forecasts. This approach requires active management and market timing skills.

- Dividend Investing: Invest in dividend-paying ETFs to generate a steady stream of income. This is particularly appealing for retirees or those seeking passive income.

- Tax-Loss Harvesting: Sell ETFs that have declined in value to realize capital losses, which can be used to offset capital gains and reduce your tax liability.

- Rebalancing: Periodically rebalance your ETF portfolio to maintain your desired asset allocation. This involves selling ETFs that have outperformed and buying those that have underperformed.

It’s important to stay informed about market trends and economic conditions to refine your ETF investment strategies. Continuous learning and adaptation are key to successful investing.

Implementing effective strategies like dollar-cost averaging, buy-and-hold, core-satellite investing, tactical asset allocation, dividend investing, tax-loss harvesting, and rebalancing can enhance your ETF investment returns while effectively managing risk.

ETFs vs. Mutual Funds: A Comparison

Investing in ETFs: A Comprehensive Guide to Exchange-Traded Funds in the Current Market often leads to a comparison with mutual funds. Understanding the differences between ETFs and mutual funds is crucial for making informed investment decisions.

ETFs trade on stock exchanges like individual stocks, while mutual funds are bought and sold directly from the fund company. This difference affects their liquidity and trading flexibility.

ETFs typically have lower expense ratios compared to actively managed mutual funds. This can result in higher returns for ETF investors over the long term.

Tax Efficiency

ETFs are generally more tax-efficient than mutual funds. Their structure allows for fewer capital gains distributions, reducing the tax burden for investors.

Trading Flexibility

ETFs offer greater trading flexibility. They can be bought and sold throughout the trading day, and investors can use strategies like limit orders and stop-loss orders.

- Minimum Investment: Mutual funds often have minimum investment requirements, while ETFs can be purchased in single shares.

- Management Style: Mutual funds can be either actively managed or passively managed, while most ETFs are passively managed to track an index.

- Transparency: ETFs typically disclose their holdings daily, while mutual funds usually disclose their holdings quarterly.

Ultimately, the choice between ETFs and mutual funds depends on your individual investment goals, preferences, and risk tolerance. Both offer diversification, but they differ in terms of cost, tax efficiency, and trading flexibility.

Comparing ETFs and mutual funds involves considering their trading mechanics, expense ratios, tax efficiency, trading flexibility, minimum investment requirements, management style, and transparency to determine which investment vehicle best aligns with your financial objectives.

| Key Highlights | Brief Description |

|---|---|

| 💰 Diversification | ETFs offer diversification by holding a basket of assets, reducing risk. |

| 💸 Cost Efficiency | Lower expense ratios compared to mutual funds increase returns. |

| 📈 Trading Flexibility | ETFs can be bought and sold throughout the trading day. |

| 📊 Strategy Variety | Implement strategies like DCA, buy-and-hold for optimal returns. |

Frequently Asked Questions

▼

An ETF, or Exchange-Traded Fund, is a type of investment fund that holds a collection of assets like stocks or bonds. It trades on stock exchanges similar to individual stocks, offering diversification and flexibility.

▼

ETFs trade like stocks on exchanges and typically have lower expense ratios. Mutual funds are bought directly from the fund company and often have higher fees, but may offer active management.

▼

The primary benefits include diversification, cost efficiency, tax efficiency, and trading flexibility. ETFs allow you to invest in a basket of assets with a single transaction.

▼

Consider your investment goals, risk tolerance, expense ratios, trading volume, and the underlying index or asset class the ETF tracks. Diversify your ETF holdings for effective risk management.

▼

Popular strategies include dollar-cost averaging, buy-and-hold, core-satellite investing, and tactical asset allocation. Rebalance your portfolio regularly to maintain your desired asset allocation.

Conclusion

Investing in ETFs offers a versatile and efficient way to diversify your portfolio and achieve your financial goals. By understanding the different types of ETFs, implementing effective investment strategies, and carefully considering your risk tolerance, you can make informed decisions and navigate the current market landscape successfully.