Investing in Commodities: A Guide to Energy, Agriculture, and Metals

Investing in commodities offers diverse opportunities across energy, agriculture, and metals, providing portfolio diversification and potential inflation hedging, but requires understanding market dynamics and inherent risks.

Considering **investing in commodities**? This guide delves into the world of energy, agriculture, and metals, exploring the potential opportunities and risks associated with each sector to provide a comprehensive overview.

Understanding Commodity Investing

Commodity investing involves allocating capital to raw materials or primary agricultural products. These tangible assets, unlike stocks or bonds, can offer diversification and a hedge against inflation. Understanding the basics is crucial before diving into specific sectors.

What are Commodities?

Commodities are basic goods used in commerce that are interchangeable with other goods of the same type. They are the building blocks of the economy and are traded on commodity exchanges worldwide.

Why Invest in Commodities?

Commodities can act as a hedge against inflation, as their prices often rise when inflation increases. They can also diversify a portfolio, as their performance is often uncorrelated with stocks and bonds.

- Portfolio Diversification: Commodities offer a unique asset class that can reduce overall portfolio risk.

- Inflation Hedge: Historically, commodity prices have risen during inflationary periods.

- Potential for High Returns: Certain commodities can experience significant price swings, offering opportunities for substantial gains.

Investing in commodities is not without risk. Price volatility, geopolitical events, and weather patterns can all impact commodity prices. Careful research and risk management are essential for successful commodity investing.

Investing in Energy Commodities

The energy sector is a significant component of the commodity market, encompassing crude oil, natural gas, and other energy sources. Investing in this sector can provide exposure to global energy demand and supply dynamics.

Crude Oil

Crude oil is the most actively traded commodity and a key driver of the global economy. Its price is influenced by a variety of factors, including geopolitical events, production levels, and demand from emerging markets.

Natural Gas

Natural gas is another important energy commodity used for heating, electricity generation, and industrial processes. Its price is affected by seasonal demand, storage levels, and production from shale gas formations.

- Geopolitical Instability: Political events in oil-producing regions can trigger price spikes.

- Demand from Emerging Markets: Growing economies like China and India drive up energy consumption.

- Technological Advancements: Developments in renewable energy technologies can impact the demand for fossil fuels.

Investing in energy commodities requires careful analysis of global energy trends, supply-demand dynamics, and geopolitical risks. Staying informed about these factors is crucial for making informed investment decisions.

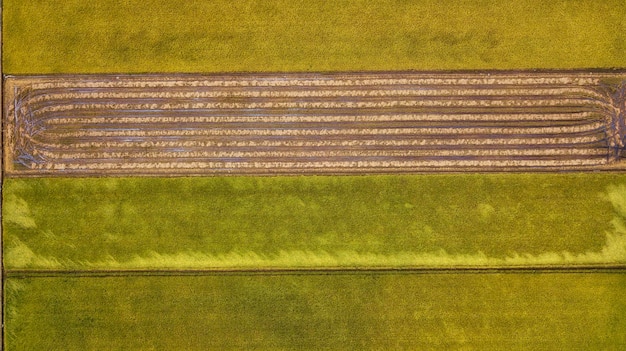

Investing in Agricultural Commodities

Agricultural commodities include crops like corn, wheat, soybeans, and livestock. These essential goods are driven by factors such as weather patterns, global demand, and government policies.

Grains (Corn, Wheat, Soybeans)

Grains are staple foods and animal feed, making them essential agricultural commodities. Their prices are impacted by weather conditions, planting decisions, and global demand.

Livestock (Cattle, Hogs)

Livestock prices are influenced by factors such as feed costs, disease outbreaks, and consumer demand for meat products. These commodities can offer diversification within the agricultural sector.

- Weather Patterns: Droughts, floods, and other weather events can significantly impact crop yields.

- Global Demand: Population growth and changing diets drive demand for agricultural products.

- Government Policies: Subsidies, trade agreements, and regulations can influence agricultural markets.

Investing in agricultural commodities requires understanding the complexities of supply chains, weather patterns, and global food demand. Farmers’ planting intentions and USDA reports are important sources of information.

Investing in Metal Commodities

Metal commodities encompass precious metals like gold and silver, as well as industrial metals like copper and aluminum. These metals are used in various industries, from electronics to construction.

Precious Metals (Gold, Silver)

Gold is often seen as a safe-haven asset, while silver has both industrial and monetary uses. Their prices are influenced by factors such as inflation, interest rates, and geopolitical uncertainty.

Industrial Metals (Copper, Aluminum)

Industrial metals are essential for manufacturing and infrastructure projects. Their prices are driven by global economic growth, construction activity, and demand from industries like automotive and aerospace.

- Economic Growth: Strong economic growth typically leads to increased demand for industrial metals.

- Geopolitical Uncertainty: Political instability can drive investors to safe-haven assets like gold.

- Inflation: Precious metals are often seen as a hedge against inflation, as their prices tend to rise when inflation increases.

Investing in metal commodities requires analysis of global economic conditions, industrial demand, and investor sentiment. Understanding the specific uses and drivers of each metal is crucial for informed investment decisions.

Strategies for Commodity Investing

Several strategies can be employed when investing in commodities, including direct investment, exchange-traded funds (ETFs), and commodity futures contracts. Each approach has its own risks and rewards.

Direct Investment

Direct investment involves buying and storing physical commodities, such as gold coins or silver bars. This approach can provide direct exposure to commodity prices but also involves storage costs and logistical challenges.

Commodity ETFs

Commodity ETFs offer a convenient way to gain exposure to a basket of commodities without the need to buy and store physical assets. These funds typically track commodity indexes or invest in commodity futures contracts.

Commodity Futures Contracts

Commodity futures contracts are agreements to buy or sell a specific commodity at a predetermined price and date. These contracts are traded on commodity exchanges and can be used to speculate on price movements or hedge against price risk.

- Diversification: Spreading investments across multiple commodities can reduce risk.

- Risk Management: Using stop-loss orders and other risk management tools can help protect capital.

- Due Diligence: Thoroughly research the commodities and investment products before investing.

Choosing the right strategy depends on individual investment goals, risk tolerance, and time horizon. Understanding the characteristics of each approach is essential for successful commodity investing.

Risks and Rewards of Commodity Investing

Commodity investing offers the potential for high returns but also comes with significant risks. Understanding these risks and rewards is crucial for making informed investment decisions.

Potential Rewards

Commodities can provide diversification, inflation hedging, and potential for high returns. They can also offer exposure to global economic growth and emerging markets.

Potential Risks

Commodity prices are often volatile and can be influenced by a variety of factors, including weather patterns, geopolitical events, and economic conditions. Investing in commodities requires careful risk management and due diligence.

- Price Volatility: Commodity prices can fluctuate significantly in short periods.

- Geopolitical Risk: Political instability in commodity-producing regions can impact prices.

- Economic Risk: Economic downturns can reduce demand for commodities, leading to price declines.

Successful commodity investing requires a thorough understanding of both the potential rewards and the inherent risks. Carefully assessing these factors is essential for making informed investment decisions.

| Key Point | Brief Description |

|---|---|

| 🌱 Agriculture | Investing in crops and livestock, influenced by weather and global demand. |

| ⚡️ Energy | Investing in oil and gas, driven by geopolitical events and energy consumption. |

| 💰 Metals | Investing in gold, silver, and industrial metals, influenced by economic growth. |

| ⚖️ Diversification | Commodities offer a unique asset class that can reduce overall portfolio risk. |

FAQ

▼

The main types of commodities include energy (crude oil, natural gas), agriculture (corn, wheat, soybeans), and metals (gold, silver, copper, aluminum), each with unique market drivers.

▼

You can invest in commodities through direct investment (physical commodities), commodity ETFs, or commodity futures contracts, each with its own set of risks and rewards.

▼

The risks include price volatility, geopolitical instability, and economic downturns, all of which can significantly impact commodity prices, requiring careful risk management.

▼

Commodities can provide portfolio diversification, acting as a hedge against inflation and potentially offering high returns, especially during periods of economic uncertainty.

▼

Weather patterns such as droughts, floods, and extreme temperatures can drastically affect crop yields, influencing the supply and price of agricultural commodities on the global market.

Conclusion

In conclusion, **investing in commodities** provides a spectrum of opportunities across energy, agriculture, and metals. While it offers diversification and inflation hedging, it’s crucial to understand the market dynamics and associated risks before allocating capital. Informed decisions, coupled with careful risk management, are key to successful commodity investing.