Investing in Bonds: Your Safe Haven in Uncertain Times

Investing in bonds can offer a refuge for portfolios during economic uncertainty, providing a stable income stream and preserving capital when equity markets face volatility, making them a potentially ‘safe haven’ asset.

Navigating today’s financial landscape requires a strategic approach, especially when uncertainty looms. Investing in bonds is often viewed as a haven, offering stability and potential returns when other investments become turbulent. Let’s explore why bonds might be your best bet in these uncertain times.

Understanding Bonds: The Basics

Bonds are essentially loans you make to a government or corporation. In return, they promise to pay you back with interest over a specified period. Understanding how they work is crucial before considering investing in them.

What is a Bond?

A bond represents debt. When you buy a bond, you’re lending money to the issuer, which could be a government, municipality, or corporation. The issuer agrees to pay you interest (called the coupon rate) over a set period, and then return the face value (or principal) of the bond when it matures.

Types of Bonds

There are different types of bonds catering to various risk tolerances and investment goals. Here are a few common ones:

- Government Bonds: Issued by national governments, these are generally considered low-risk, especially those from stable economies like the U.S. Treasury bonds.

- Corporate Bonds: Issued by corporations to raise capital. The risk level varies depending on the financial health of the company. Higher-rated bonds are considered safer, while lower-rated (or junk) bonds offer higher yields to compensate for the increased risk.

- Municipal Bonds (Munis): Issued by state and local governments. They are often tax-exempt, making them attractive to investors in high-tax brackets.

- Treasury Inflation-Protected Securities (TIPS): These government bonds are indexed to inflation, protecting investors’ purchasing power.

Understanding these basics allows investors to make informed decisions about whether investing in bonds aligns with their financial objectives and risk profile.

Why Bonds Are Considered a Safe Haven

During times of economic uncertainty, investors often flock to assets that can preserve capital and offer a steady income. This is where bonds come into play, offering several characteristics that make them a safe haven.

Stability and Predictable Income

Bonds typically provide a more stable investment than stocks. Fixed coupon payments offer a predictable income stream, regardless of market conditions. This can be particularly appealing when stock markets are volatile.

Preservation of Capital

Bonds are generally less volatile than stocks. While their value can fluctuate, especially with changing interest rates, they are designed to return the principal amount at maturity. This characteristic helps preserve capital, especially when compared to riskier assets like equities.

Diversification Benefits

Bonds often have a low or negative correlation with stocks. When stock prices fall, bond prices may rise (especially government bonds), providing a cushion for your portfolio. This diversification can reduce overall portfolio risk.

The perception of bonds as a safe haven is rooted in their ability to offer stability, income, and diversification benefits, making them an attractive option during uncertain times.

Assessing the Risks: Not Always a Smooth Ride

While bonds are generally considered safer than stocks, they are not without risk. Understanding these risks is essential for making informed investment decisions.

Interest Rate Risk

This is one of the primary risks associated with bonds. When interest rates rise, the value of existing bonds falls. This happens because new bonds are issued with higher coupon rates, making older bonds less attractive.

Inflation Risk

Inflation can erode the real return of bonds. If inflation rises faster than the coupon rate, the purchasing power of your investment decreases. TIPS are designed to mitigate this risk, but other bonds are vulnerable.

Even though bonds are safer than certain investments, it’s important to review all possible risks before investing in bonds.

Credit Risk

This is the risk that the bond issuer may default on its obligations. Credit rating agencies like Moody’s and Standard & Poor’s assess the creditworthiness of bond issuers. Higher-rated bonds have a lower credit risk, while lower-rated bonds have a higher risk.

Building a Bond Portfolio

Creating a bond portfolio involves considering several factors, including your investment goals, time horizon, and risk tolerance. Here are some strategies to consider.

Determine Your Investment Goals

Are you looking for income, capital preservation, or diversification? Your investment goals will guide your bond selection. For example, if you need income, you might focus on bonds with higher coupon rates. If capital preservation is your primary goal, you might opt for government bonds with shorter maturities.

Consider Your Time Horizon

The length of time you plan to hold the bonds will influence your choice of maturity. If you have a short time horizon, you might prefer shorter-term bonds to minimize interest rate risk. If you have a longer time horizon, you can consider longer-term bonds, which typically offer higher yields but are also more sensitive to interest rate changes.

Diversify Your Bond Holdings

Diversification is key to managing risk. Don’t put all your eggs in one basket. Consider investing in a mix of government, corporate, and municipal bonds, as well as bonds with different maturities. You can also invest in bond mutual funds or ETFs, which provide instant diversification.

Building a bond portfolio requires careful consideration of your goals, time horizon, and risk tolerance. Diversification and professional advice can help you create a portfolio that meets your needs and provides a safe haven during uncertain times.

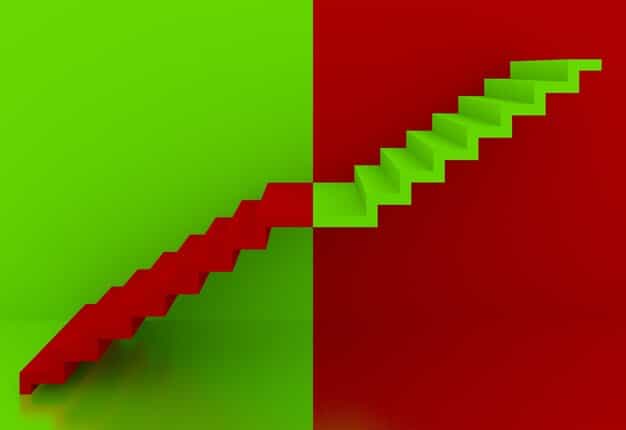

Bonds vs. Other Safe Haven Assets

While bonds are a popular choice, various other assets are also considered safe havens. Understanding how bonds compare to these alternatives can help you make informed decisions.

Gold

Gold is often seen as a hedge against inflation and economic uncertainty. Unlike bonds, gold doesn’t provide a regular income stream. Its value is based on investor sentiment and can be volatile. While gold can be a useful diversifier, it may not offer the same level of stability as bonds.

Cash

Holding cash is the safest option, but it comes with the trade-off of earning little to no return. Inflation can erode the purchasing power of cash over time. While cash is useful for short-term needs and emergencies, it may not be the best long-term safe haven asset.

Real Estate

Real estate can be a stable investment, but it is illiquid and requires significant capital. Property values can fluctuate, and real estate investments come with expenses like maintenance and property taxes. While real estate can provide rental income and potential appreciation, it may not offer the same level of liquidity and diversification as bonds.

Investing in bonds offers a valuable equilibrium between protection, diversification, and potential return, specifically during periods of market uncertainty, when compared against other safe investment options.

The Role of Bonds in Retirement Planning

Bonds play a crucial role in retirement planning, providing stability and income during your golden years. As you approach retirement, shifting a portion of your portfolio from stocks to bonds can reduce risk and provide a more predictable income stream.

Generating Income

Bonds can provide a reliable source of income during retirement. Fixed coupon payments can help cover living expenses and supplement other sources of retirement income, such as Social Security and pensions.

Reducing Portfolio Volatility

As you age, your risk tolerance typically decreases. Bonds can help reduce the volatility of your portfolio, protecting your savings from market downturns. This is especially important during retirement when you are relying on your investments to generate income.

Balancing Growth and Safety

A well-balanced retirement portfolio includes both growth assets (like stocks) and safe haven assets (like bonds). The right mix will depend on your individual circumstances, including your age, health, and financial goals. Consulting with a financial advisor can help you determine the optimal asset allocation for your retirement portfolio.

Key HighlightsBrief Description Investing in bonds💱Provides stability and a predictable income stream, making it a safe haven during uncertain times. Risk assessment📊Understand the associated risks, such as interest rate, inflation, and credit risk. Portfolio construction 📈Diversify to align well with your goals. Retirement planning 🎯Shift to bonds as you approach retirement to reduce risk and ensure a steady income.

Section Title

Question 1 What exactly are bonds, and how do they function?

Answer 1Bonds are essentially loans you provide to the government or a corporation. In exchange, the borrower commits to repaying you, alongside interest, across a period that’s already set.

Question 2 What makes bonds a safe investment in volatile markets?

Answer 2Bonds provide a more stable investment when contrasted with stocks. Set coupon bills give a predictable income, regardless market conditions. This can be mainly appealing when stock markets are moving up and down.

Question 3 What are the potential risks associated with bond investments?

Answer 3One of the main risks associated with bonds the risk from changes in interest rates. If go up, the value of existing bonds goes down, as new bonds are issued with higher coupon rates, making the older and existing ones less appealing.

Question 4 How can bonds assist with retirement planning?

Answer 4Bonds play a significant part in planning a retirement, offering balance and income throughout the golden years. As you get closer to retirement, moving a portion of resources into bonds can ensure balance and a stable income.

Question 5 What’s the difference between treasury bonds vs corporate bonds?

Answer 5Treasury bonds are issued by the government and are deemed low risk, and corporate bonds issued by companies, come with a bit more risk.

Conclusion The decision of whether or not to invest in bonds should align well with individuals’ needs. During times of economic uncertainty, investing in bonds is often a reliable strategy. By understanding the basics, assessing the risks, and building a diversified portfolio, you can use bonds to protect your capital and achieve your financial goals.

Read more content