Understanding Supplemental Security Income (SSI): A Comprehensive Guide

Understanding Supplemental Security Income (SSI) involves navigating eligibility, payment details, and the application process; this guide provides a detailed breakdown to help those in need access vital financial assistance, ensuring a clearer path to federal support.

Navigating government benefits can be complex, but understanding programs like Supplemental Security Income (SSI) is crucial for those who need assistance. This guide aims to simplify the process of understanding Supplemental Security Income (SSI): Eligibility Requirements, Payment Amounts, and How to Apply, ensuring you have the information needed to determine eligibility and apply confidently.

What is Supplemental Security Income (SSI)?

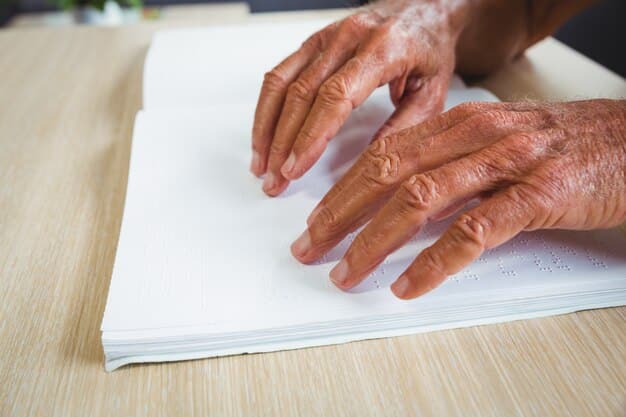

Supplemental Security Income (SSI) is a federal program designed to help aged, blind, and disabled people who have little or no income. Administered by the Social Security Administration, SSI provides cash assistance to meet basic needs for food, clothing, and shelter. Knowing the nuances of this program can be a lifeline for many.

SSI is more than just a welfare program. It’s a critical component of the social safety net, designed to ensure a minimum level of financial security for vulnerable populations. Let’s explore the key aspects of this vital support system.

Purpose of SSI

The primary goal of SSI is to provide a safety net for those who cannot support themselves due to age, disability, or blindness. The program ensures that eligible individuals have a basic income to cover essential living expenses, fostering dignity and independence.

SSI acts as a financial backstop, offering monthly payments to those who meet specific criteria related to income, resources, and medical condition (if applicable).

Who is Eligible?

Eligibility for SSI is based on several factors, including age, disability, income, and resources. Generally, SSI is available to individuals who are:

- Aged (65 or older)

- Blind or disabled

- Have limited income and resources

- Are U.S. residents

Meeting these criteria is the first step in determining whether you qualify for SSI benefits. Let’s delve deeper into each requirement to give you a clearer picture of your eligibility.

Detailed Eligibility Requirements for SSI

Understanding the specific eligibility requirements for Supplemental Security Income (SSI) is crucial for a successful application. These requirements cover various aspects, including age, disability, income, and residency. Let’s break down each component in detail.

The eligibility criteria are designed to ensure that SSI benefits reach those who genuinely need them. By understanding these guidelines, you can more effectively assess your potential eligibility and prepare your application.

Age Requirements

To qualify for SSI based on age, you must be 65 years or older. This requirement aims to provide support for older adults who may no longer be able to work or have sufficient retirement income.

If you are under 65, you may still be eligible for SSI based on blindness or disability, which we’ll explore in the following sections.

Disability or Blindness

Individuals under 65 can qualify for SSI if they are blind or have a disability that prevents them from engaging in substantial gainful activity (SGA). The Social Security Administration (SSA) has specific criteria for determining disability and blindness.

Disability, in this context, refers to a physical or mental impairment that severely limits your ability to perform basic work-related activities. Blindness is defined as having vision no better than 20/200 with corrective lenses, or a limited field of vision of 20 degrees or less.

Income Limits

SSI has strict income limits, which vary depending on your marital status and state of residence. The SSA considers both earned income (from wages or self-employment) and unearned income (from sources like Social Security benefits, pensions, or gifts).

The income limits are adjusted annually to reflect changes in the cost of living. As of 2024, the general income limit for an individual is relatively low, meaning you must have very little income to qualify. The SSA also applies various exclusions to certain types of income, which can reduce the amount counted against the limit.

Resource Limits

In addition to income limits, SSI also has resource limits. Resources include assets like bank accounts, stocks, bonds, and real estate (other than your primary residence). Like income limits, resource limits are also relatively low.

Certain resources are excluded from consideration, such as your primary home, one vehicle used for transportation, and certain personal belongings. However, it’s crucial to understand which assets count toward the resource limit to accurately assess your eligibility.

Residency and Citizenship

To be eligible for SSI, you must be a U.S. resident. This generally means you must live in one of the 50 states, the District of Columbia, or the Northern Mariana Islands. Certain non-citizens may also be eligible for SSI, provided they meet specific requirements related to their immigration status.

Meeting the residency and citizenship requirements is a fundamental aspect of SSI eligibility. If you have questions about your residency status, it’s best to consult with the SSA or an immigration attorney.

How Much Can You Receive from SSI?

The amount of SSI benefits you can receive depends on various factors, including your income, marital status, and state of residence. The federal government establishes a standard monthly payment amount, which is adjusted annually to reflect changes in the cost of living. Some states also supplement the federal SSI payment, resulting in higher benefit amounts.

Understanding how the SSI payment amount is calculated can help you estimate the benefits you may be eligible to receive. Let’s explore the key components that determine your SSI payment.

Federal Benefit Rate (FBR)

The Federal Benefit Rate (FBR) is the maximum monthly SSI payment that an eligible individual can receive. This rate is set by the federal government and adjusted annually to account for inflation. As of 2024, the FBR for an individual is a specific amount, while the FBR for a couple is higher.

It’s important to note that the FBR is not necessarily the amount you will receive. Your actual SSI payment will be reduced if you have countable income, meaning income that is not excluded by the SSA.

Income Reductions

The SSA reduces your SSI payment based on your countable income. This includes both earned income (from wages or self-employment) and unearned income (from sources like Social Security benefits, pensions, or gifts). However, the SSA applies various exclusions to certain types of income, which can reduce the amount counted against your SSI payment.

For example, the SSA excludes a certain amount of earned income and a smaller amount of unearned income each month. By understanding these exclusions, you can better estimate the impact of your income on your SSI benefit amount.

State Supplements

Some states supplement the federal SSI payment, providing additional benefits to eligible residents. These state supplements vary in amount and eligibility criteria. If you live in a state that offers an SSI supplement, your total SSI payment will be higher than the federal FBR.

To learn more about state SSI supplements, you can contact your local Social Security office or state social services agency. They can provide information about the amount and eligibility rules for state supplements in your area.

Living Arrangements

Your living arrangements can also affect your SSI payment amount. If you live in someone else’s household and receive support and maintenance from them, your SSI payment may be reduced. This is known as “in-kind support and maintenance.”

However, if you are paying your fair share of household expenses, such as rent and utilities, your SSI payment will not be reduced due to in-kind support and maintenance. It’s essential to accurately report your living arrangements to the SSA to ensure you receive the correct SSI payment amount.

Applying for Supplemental Security Income (SSI)

Applying for Supplemental Security Income (SSI) involves several steps, from gathering necessary documentation to completing the application form and attending interviews. Knowing what to expect during the application process can help you prepare and increase your chances of a successful outcome.

The SSI application process can be complex, but with proper preparation and attention to detail, you can navigate it effectively. Let’s explore the key steps involved in applying for SSI.

Gathering Documentation

Before you begin the SSI application, it’s essential to gather all necessary documentation. This includes:

- Proof of age (such as a birth certificate)

- Social Security card

- Proof of U.S. residency (such as a driver’s license or lease agreement)

- Information about your income and resources (such as bank statements and pay stubs)

- Medical records and information about your medical condition (if applying based on disability or blindness)

Having these documents readily available will streamline the application process and help ensure that your application is complete and accurate.

Completing the Application Form

You can apply for SSI online, by phone, or in person at your local Social Security office. The application form requires detailed information about your income, resources, living arrangements, and medical condition (if applicable).

Be sure to answer all questions accurately and completely. If you need assistance completing the application form, you can contact the SSA or seek help from a social worker or community organization.

Attending Interviews

As part of the SSI application process, you may be required to attend interviews with SSA representatives. These interviews are designed to gather additional information about your eligibility and verify the information provided in your application.

Be prepared to answer questions about your income, resources, living arrangements, and medical condition. It’s helpful to bring any relevant documentation to the interview, such as medical records or bank statements.

Medical Examination

If you are applying for SSI based on disability or blindness, the SSA may require you to undergo a medical examination by a doctor or other healthcare professional. This examination is designed to assess your medical condition and determine whether it meets the SSA’s definition of disability or blindness.

The SSA will pay for the medical examination, and you will be notified of the date, time, and location of the examination. Be sure to attend the examination as scheduled and provide accurate information about your medical history and current condition.

Tips for a Successful SSI Application

Submitting a strong and complete application is key to receiving Supplemental Security Income (SSI) benefits. By focusing on accuracy, clarity, and providing comprehensive supporting documentation, you enhance your chances of approval. Navigating the process with well-organized information can streamline the review and decision-making process.

Additionally, understanding the intricacies of the SSI program and its requirements allows you to proactively address potential gaps or issues in your application, ensuring that you present a compelling case for your eligibility.

Be Thorough and Honest

- Provide all requested information and documentation.

- Answer questions truthfully and accurately.

- Disclose all income and resources.

Seek Assistance When Needed

- Don’t hesitate to ask for help from the SSA, social workers, or community organizations.

- Consider hiring an attorney or advocate to represent you.

Stay Organized

- Keep copies of all documents you submit to the SSA.

- Track deadlines and appointments.

- Maintain a log of communications with the SSA.

Follow Up

- Check the status of your application regularly.

- Respond promptly to requests for additional information.

- Appeal any unfavorable decisions.

Appealing an SSI Decision

If your application for Supplemental Security Income (SSI) is denied, you have the right to appeal the decision. The appeals process involves several levels, from reconsideration to a hearing before an administrative law judge (ALJ). It’s essential to understand the appeals process and your rights as an applicant.

Appealing an SSI decision can be a complex undertaking, but with proper preparation and persistence, you can increase your chances of a successful outcome. Let’s explore the key steps involved in the SSI appeals process.

Reconsideration

The first step in the SSI appeals process is reconsideration. This involves having your case reviewed by a different SSA representative than the one who made the initial decision. You must request reconsideration in writing within 60 days of receiving the denial notice.

During reconsideration, you can submit additional evidence or information to support your case. The SSA representative will review all of the evidence and make a new decision.

Hearing Before an ALJ

If your request for reconsideration is denied, you can request a hearing before an administrative law judge (ALJ). The ALJ is an independent judge who will review your case and make a decision based on the evidence presented at the hearing. You must request a hearing in writing within 60 days of receiving the reconsideration denial notice.

At the hearing, you have the right to testify, present evidence, and question witnesses. You can also hire an attorney or advocate to represent you at the hearing.

Appeals Council Review

If you disagree with the ALJ’s decision, you can request a review by the Appeals Council. The Appeals Council reviews cases to determine whether the ALJ’s decision was supported by substantial evidence and free from legal error. You must request an Appeals Council review in writing within 60 days of receiving the ALJ’s decision.

The Appeals Council may deny your request for review, affirm the ALJ’s decision, or remand the case back to the ALJ for further consideration.

Federal Court Review

If the Appeals Council denies your request for review or affirms the ALJ’s decision, you can file a lawsuit in federal court. This is the final step in the SSI appeals process. You must file a lawsuit within 60 days of receiving the Appeals Council’s decision.

Filing a lawsuit in federal court can be a complex and costly undertaking. It’s essential to consult with an attorney to determine whether it’s the right course of action for your case.

| Key Concept | Brief Description |

|---|---|

| 💰 SSI Purpose | Provides financial aid to aged, blind, or disabled individuals with limited income. |

| 📝 Eligibility | Age 65+, blind, or disabled with income/resources below specified limits. |

| ⚖️ Income Limits | Limits on both earned and unearned income apply; certain income is excluded. |

| 🗓️ Application | Apply online, by phone, or in person; gather documentation, attend interviews. |

Frequently Asked Questions (FAQ)

▼

SSI is a needs-based program funded by general tax revenues, while Social Security is an insurance program funded by payroll taxes. SSI provides benefits to aged, blind, or disabled individuals with limited income and resources, regardless of work history.

▼

Yes, it is possible to receive both SSI and Social Security benefits concurrently. However, your Social Security benefits may reduce your SSI payment, as they count as unearned income. The impact depends on the amount of your Social Security benefit.

▼

Certain resources are excluded when determining SSI eligibility, including your primary home, one vehicle used for transportation, household goods, and personal effects. Specific retirement accounts may also be excluded under certain conditions.

▼

The Social Security Administration (SSA) periodically reviews SSI eligibility to ensure recipients continue to meet the program’s requirements. The frequency of these reviews depends on various factors, such as age, medical condition, and changes in income or resources.

▼

If your SSI benefits are terminated, you have the right to appeal the decision. You must request reconsideration in writing within 60 days of receiving the termination notice. Seeking legal assistance and gathering supporting documentation can be beneficial.

Conclusion

Understanding the intricacies of Supplemental Security Income (SSI) is crucial for those who need financial assistance due to age, disability, or blindness. By understanding your eligibility, knowing how much you can receive, and following the application process, you can access this vital support system and improve your quality of life.